Shopping for a new home is an emotional experience. It’s also time consuming and comes with a myriad of details.

These errors generally fall into three areas:

1. Paying too much

2. Losing a dream home to another buyer

3. Buying the wrong home

When you have a systematic plan before you shop, you will be sure to avoid these costly errors. Here are some tips on making the most of your home purchase:

Bidding without sufficient information - What price do you offer a seller? Is the seller’s asking price too high? Is it a deal? Without a realtor’s research on the market and comparable homes, you could lose thousands of dollars. Only realtors have access to sound historical sales information.Before you make that offer, be sure you have researched the market. A Real Estate Professional can offer an unbiased opinion on the value of a home, based on market conditions, condition of the home and neighborhood. Without knowledge of the market, your offer could be too much. Or worse, you could miss out on a great buying opportunity.

Buying a mis-matched home - What do you need and want in a home? Sounds simple. Yet, clearly identifying your needs and bringing an objective view to home shopping, leaves you in a better position. Sometimes, home buyers buy a home that is too large or too small. Perhaps they didn’t consider the drive to work, the distance to school, or the many repair jobs waiting for completion. Plan ahead. Use your needs list as a guideline for every home you view.

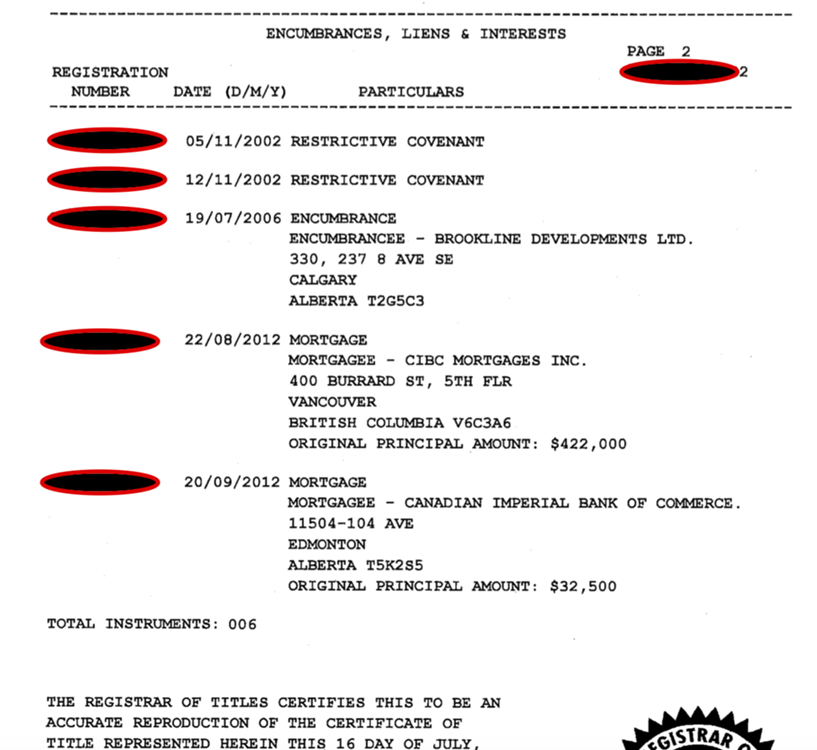

Unclear title - Before you sign any document, be sure the property you are considering is free of all encumbrances. As part of their services, Real Estate Professionals can supply you with a copy of the title to ensure there are no liens, debts, undisclosed owners, leases or easements. As well, your lawyer will ensure that you do not assume anybody else’s liens.

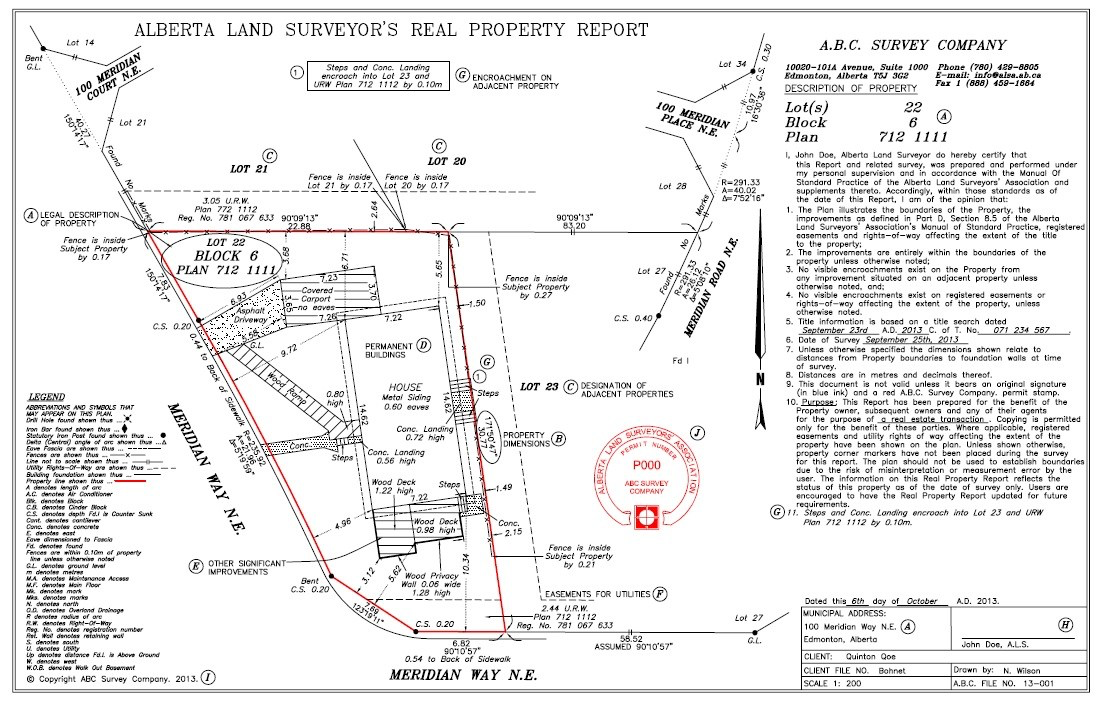

Outdated Real Property Report - Before the purchase is completed, an updated survey is essential. This report will indicate boundaries and structural changes (additions to the house, a new swimming pool, a new fence which is extending a boundary line, etc.). Unless otherwise indicated, it is the responsibility of the seller to pay for a survey and provide a copy to the purchasers and their lawyer as a term of the sale.

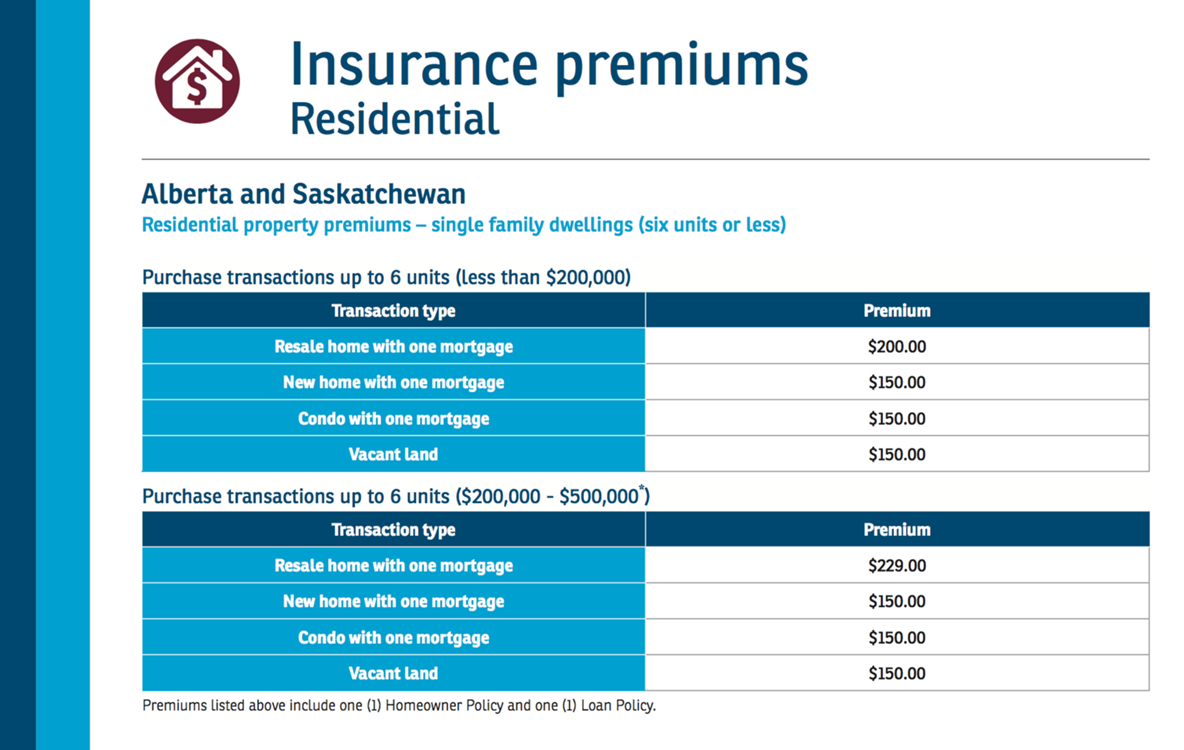

Purchase Title Insurance - For around Title insurance is a relatively inexpensive way to protect matters related to the interior of your home.

Unexpected repairs - For around $500-$600 a professional inspector will conduct a thorough inspection of the home. This way, you’ll have an idea of the cost of future repairs. Most home inspectors will provide information on the maintenance of your home to avoid costly future repairs. Make the final contract subject to a favourable report.

Shopping without pre-approval - It only takes a few days to get financing pre-approval. When you are shopping for a home, this gives you more power. A seller is more likely to consider an offer from a serious buyer. We have numerous connections with highly qualified Mortgage professionals. We would be happy to make these connections for you.

Remember additional costs - Besides the funds for the purchase of a home, you will need funds for items such as loan application fees, insurance, legal fees, surveys, inspections, etc. A general rule of thumb is that your closing costs will be approximately 1.5% of the Final Sale Price that you paid for the property.

Rushing the closing - Before you sign, ensure that all documentation clearly reflects your understanding and conditions of the transaction. Has anything been forgotten? Don’t rush. You could lose money or even the sale. A Real Estate Professional has the knowledge and experience to protect you. Your Real Estate Professional can assist you in shopping for the best home at the best price.